Highlights

- Cost containment in healthcare is a significant concern for small and midsized companies.

- Many SMBs are discovering the advantages of transitioning from a fully funded to a self-funded insurance plan.

- Self-insured (or self-funded) insurance provides financial control, data transparency, flexible plan designs, and stop-loss insurance against high-cost claims.

- With up to 85% in variable vs fixed costs, self-funded insurance can offer substantial savings compared to fully insured plans.

- While fully insured carriers bear all financial risk, self-funded employers can reduce risk by using a group captive.

- Self-funding allows you to customize health coverage to meet your employees’ needs, providing greater flexibility and personalization than fully insured plans.

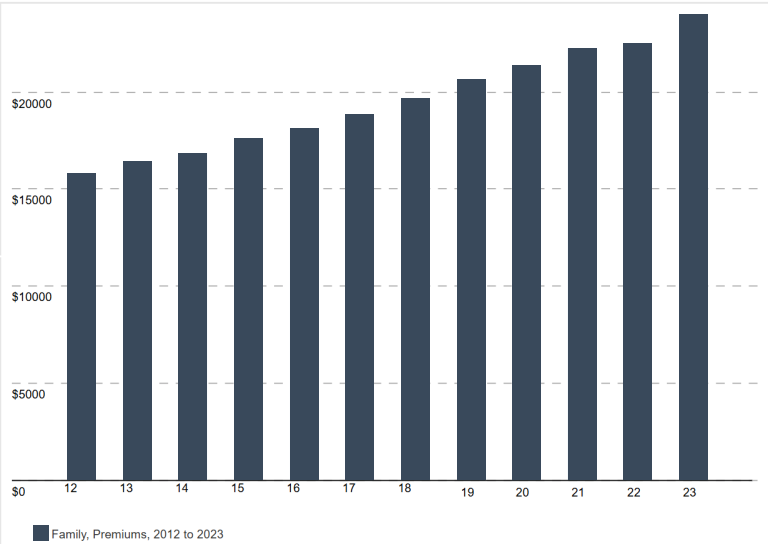

Most small to midsize businesses (SMBs) feel the pressure of skyrocketing healthcare costs. Over the past 11 years, premiums for fully insured plans have surged by 47%, resulting in higher out-of-pocket expenses and diminishing company health benefits.

Annual Premium Increases for a Family Healthcare Plan

2012-2023

Source: KFF 2023 Employer Health Benefits Survey

As traditional employee health insurance premiums become unsustainable, business owners are looking for alternatives to fully funded insurance. Self-funding through a group captive is emerging as a more affordable option that provides significant opportunity for cost containment through data transparency and plan flexibility.

Let’s take a look at the major differences between the two options.

Fully Insured vs. Self-Insured Employee Health Plans

In fully funded employee health insurance plans, the insurer controls cost containment. These fully insured options lack claims data transparency, restricting SMBs’ ability to manage costs. As a result, premiums continue to rise, out-of-pocket expenses increase, and employee health and your business’s bottom line are adversely affected.

Self-funded health insurance provides SMBs with a more tailored, data-driven way to manage healthcare costs, offering an alternative to traditional plans. Choosing between self-insured and fully insured health plans can impact your healthcare cost control and overall cost containment strategy.

Learn how self-insurance impacts cost containment in healthcare, helping you reduce spending and provide better coverage for your employees.

The Challenges of Fully Insured Health Plans

Fully insured health plans are the traditional approach to buying health insurance. Here’s how they work: your business pays a fixed monthly premium to an insurance carrier covering your employees’ healthcare costs. These premiums stay the same no matter how much or how little your employees use healthcare services.

It is a “set it and forget it” approach that sounds good on paper but can become unmanageable over time.

Fully insured company health plans often result in the following challenges for your management team:

- Fixed costs. You’re locked into fixed premiums, making adjusting spending based on actual healthcare usage difficult. Are your employees taking advantage of benefits like preventive services or well-being programs? With a fully funded plan, you pay for these features even if none of your employees use them.

- Limited flexibility. These employee health benefits plans often don’t allow for customization, leaving you with a one-size-fits-all approach that may not align with your employees’ needs.

- Lack of transparency. Without clear insight into where your money is going, medical cost management can feel like a guessing game. Worse, regardless of the coverage your employees actually use, you will receive price increases every year with no explanation as to why.

The Advantages of Self-Insured Health Plans

Self-insured health plans redefine traditional healthcare coverage by putting control back in your hands. Instead of paying fixed premiums to an insurance carrier, you only pay for the healthcare services your employees actually use.

You also benefit from health plan transparency, which gives you claims data access for action-based insights.

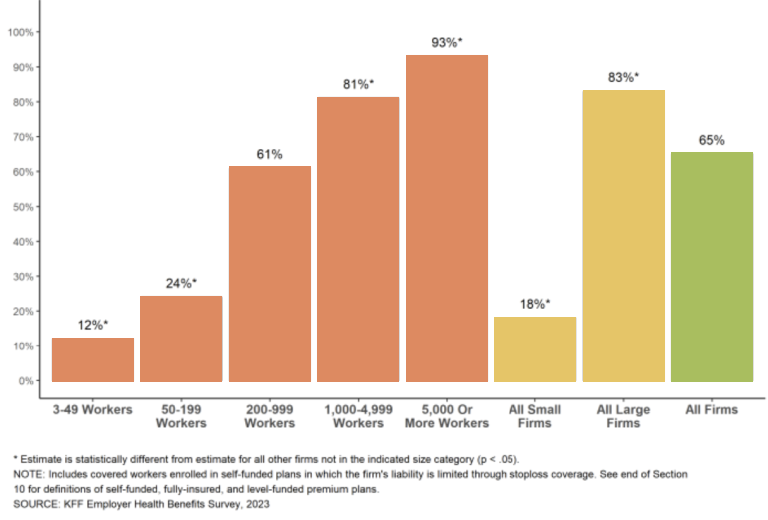

This approach can save money since you no longer pay for unused services. It’s becoming a popular strategy for cost containment in healthcare; 65% of covered workers in 2023 enrolled in a self-funded plan.

Percentage of Covered Workers Enrolled in a Self-Funded Plan, by Firm Size, 2023

Additional advantages of self-insured plans include:

- Cost savings. You pay only for the services your employees use, avoiding the extra costs associated with unused benefits in traditional plans. Notice an unutilized benefit? Remove it from your plan immediately or replace with more cost-effective options.

- Data transparency. With self-insurance, you have complete access to claims data. Healthcare price transparency allows you to see exactly where your money is going, making it easier to identify trends, manage expenses, and make data-driven decisions about your healthcare strategy.

- Flexibility. Self-insured plans allow you to tailor coverage to the specific needs of your workforce. Design a plan that aligns perfectly with your employees’ needs, whether providing specialized mental health services or better prescription coverage.

How Self-Insurance Supports Healthcare Cost Control

With self-insurance, you can take a proactive role in healthcare cost control. In the Roundstone Captive, about 85% of self-funded insurance costs are variable, allowing you to use cost containment strategies to lower expenses as soon as you identify an issue.

Here are areas where you can make a difference in the cost of your plan with self-funding.

| Plan Area | Explanation | Action |

| Claims Management | Monitor claims data in real-time to identify and address cost drivers, preventing small issues from becoming major expenses. |

|

| Plan Design Flexibility | Customize your plan to ensure you only pay for what your employees need, reducing waste and cutting unnecessary costs. |

|

| Plan Partners | Choose the right Third-Party Administrator (TPA) and Pharmacy Benefits Manager (PBM) to get the best value for your healthcare dollars. |

|

| Vendors and Providers | Partner with high-quality vendors and providers to access cost-effective care and innovative tools. |

|

| Employee Engagement | Involve employees in their healthcare choices to encourage smarter decisions, leading to better health outcomes and lower costs. |

|

How Self-Funding Prioritizes Price Transparency for Cost Containment

Healthcare price transparency allows employers to manage costs by showing where their money is spent. With clear visibility into spending, companies can identify wasteful expenses and create data-driven strategies to reduce unnecessary costs.

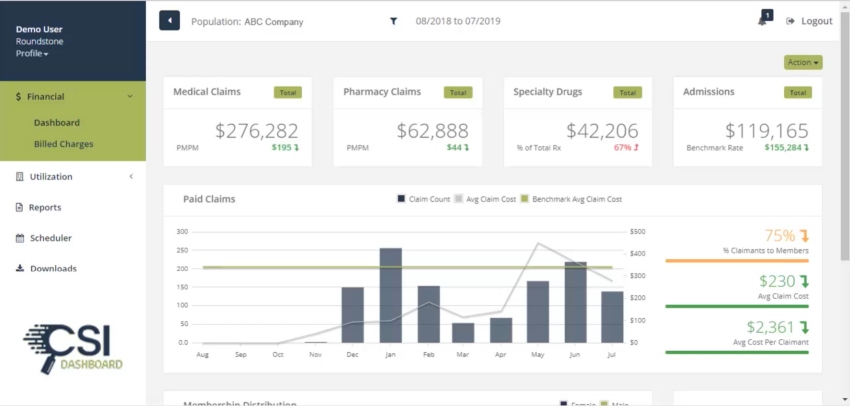

At Roundstone, our CSI Dashboard provides detailed insights into claims data. You can break down costs by category, provider, and service for a clear understanding of your spending. You can then make changes that lower costs or enhance coverage where needed.

For instance, you can monitor prescription drug spending by specific medications or pharmacies or analyze data on high-cost services like urgent care and emergency room visits. Use these insights to negotiate better rates, refine plan designs, and guide employees toward smarter, more cost-effective healthcare decisions.

Why Switch to a Roundstone Group Captive Plan?

Wondering how Roundstone’s self-funded insurance can help you save on healthcare costs? Our self-insured plans give you the tools to manage healthcare expenses with transparency and flexibility. You get real-time access to claims data, so you can make smarter decisions and keep spending in check.

But what sets Roundstone apart from other group-captive companies? We walk the walk. Our customers, like Totem Solutions, have seen benefits like $6,000 in savings the first year and zero-dollar deductibles. As an SMB, we joined our own group captive eight years ago, leading to stable premiums and better benefits for our employees.

Since 2003, we’ve given back $91.8 million to participating businesses, with 100% of unspent funds going straight back to clients at the end of the year. On average, members save 20% annually compared to fully insured plans, and many save enough in four years to cover their fifth year of claims. We guarantee you’ll save money, full stop.

Want to learn more about fully funded vs self-funded health insurance? Download the eBook that will open your eyes about the disadvantages of traditional employee health insurance. It’s free!

Explore Self-Insured Plans With Roundstone for Better Medical Cost Management

ROUNDSTONE is an innovative employee health benefits company. We help small and midsize organizations offer competitive benefits at a lower cost by self-funding health insurance through our group medical captive.

The Roundstone stop-loss captive enables companies to self-insure safely by pooling hundreds of employers together to share risk and save money. With easy onboarding and personalized support every step of the way, the Captive offers control, flexibility, transparency, and returns all savings back to employers where they belong.

We believe in always aligning with the employers’ best interests and remain committed to our mission — quality, affordable healthcare benefits and a better life for all.

Healthcare cost control is essential for businesses looking to maximize their benefits while minimizing expenses.

Speak with Roundstone today to learn more about how to make the switch and start saving.