Setting up or running the small business of your dreams? Reduce your risks with these 13 retail store safety tips:

- Step up your security. Minimize crime with security cameras, ample exterior lighting, and alarm systems. Ensure your security cameras cover key entrances and blind spots and invest in quality equipment. Teach team members how to turn alarms on and off. If an employee leaves your company, promptly change your alarm codes and passwords.

- Think like a thief. Pretend you’re an intruder. What valuables can you easily spot from outside? What would you take? How would you get away with it? Putting yourself in a robber’s shoes can help you make proactive adjustments and prevent crime.

- Drop off deposits. How much cash should you keep in your register? Choose a small amount you can still conduct business with and deposit the rest. In the event of a robbery, there will be less available to take. Additionally, avoid being too predictable by taking different routes to the bank.

- Set out signs. If an area is under construction or out of order, note these hazards with clear signage. It’s also important to set out cones or wet floor signs when water is tracked inside or if something is leaking. Encourage your team members to be proactive about cleaning hazards and marking them.

- Clear the clutter. If a customer falls and gets injured at your business, you could face expensive legal action. Avoid the risk by doing frequent decluttering sessions and minimizing tripping hazards on the floor and in high-traffic areas.

- Be aware of your surroundings. Visibility helps make your retail store safer. When you’re in the store, you should be able to see out, and passersby should be able to see in. This way, your employees will see if someone dangerous is approaching. Additionally, onlookers will see if something dangerous, like a robbery, is happening inside and can call for help.

- Add lighting. Eliminate any dark areas in your store and keep extra light bulbs easily accessible in a low bin or cabinet.

- Add fire extinguishers. Every building should have a fire extinguisher on each floor. Get them inspected and tagged annually and give employees a refresher on how to use them.

- Report potholes in your parking lot. Large cracks or craters could cause bodily harm or damage to vehicles. Contact your county, contractor, or the property owner to take care of them promptly.

- Carefully screen candidates. Before you hire new team members, check their backgrounds. Meet them in person or talk to them on the phone to help verify their reputability.

- Train your talent. Training is one of the most essential parts of hiring. Conduct extensive training for anything that’s part of a team member’s job description, as well as other functions of your business they may need to know. The better an employee is trained, the safer and more equipped they’ll be to navigate the job.

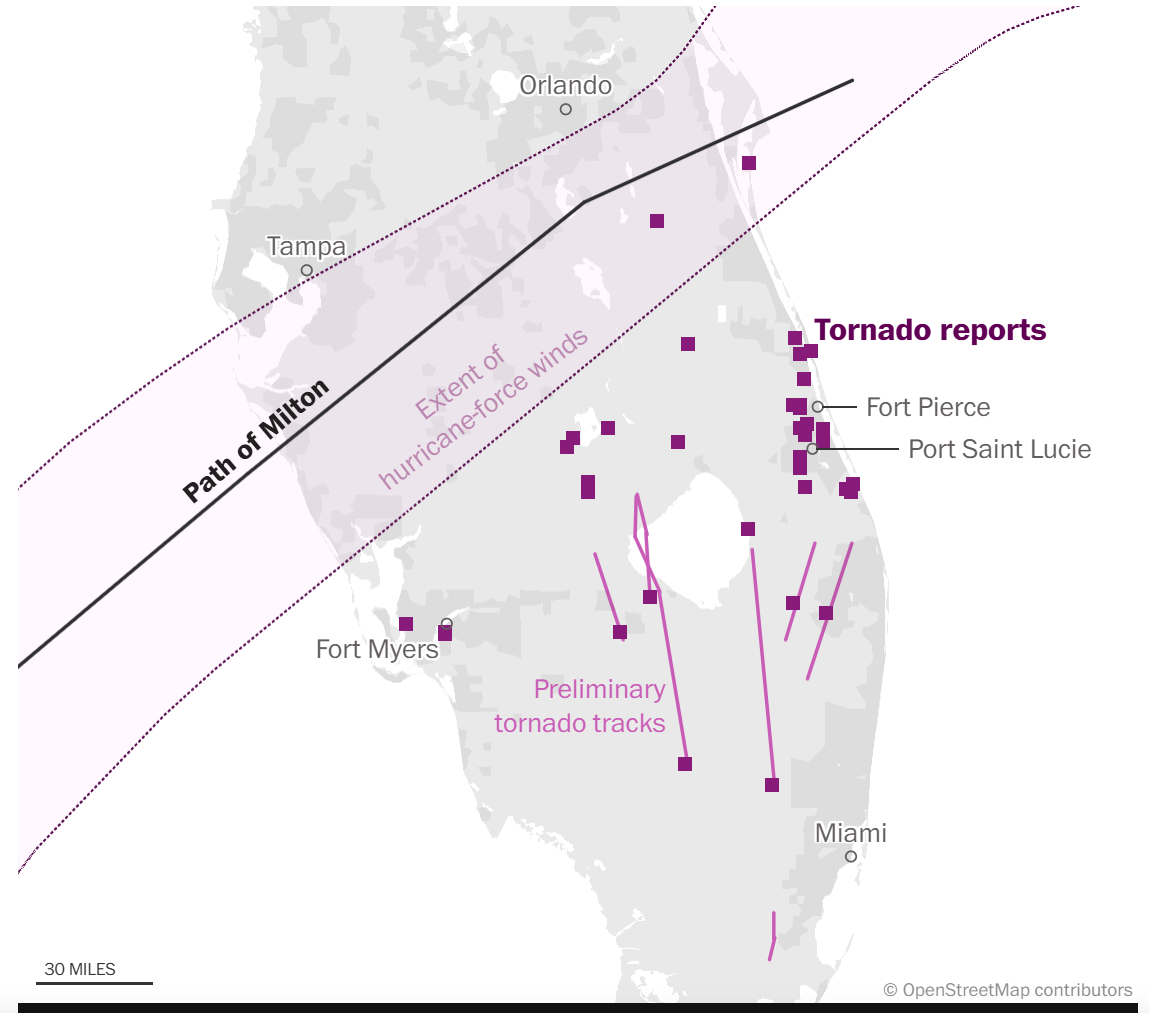

- Be prepared for disaster. The best businesses are prepared for disasters and unexpected closures. Since you never know when one could strike, it’s crucial to be proactive with a disaster preparedness plan that includes steps for closing, reopening, and contacting your team and customers.

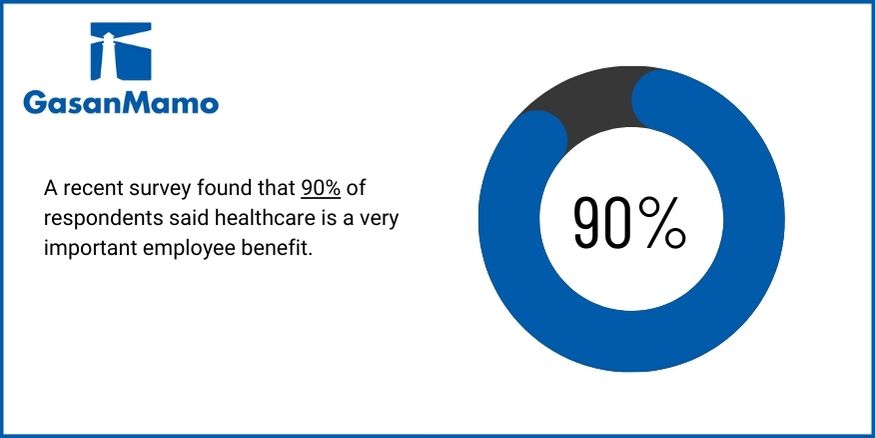

- Invest in insurance. As a small business owner, you have enough things on your mind. Insurance shouldn’t be one of them. Get commercial coverage you can count on, like liability, workers compensation, or umbrella policies.

Could your retail store be more secure? Let our experts be the judge. Talk to a local, independent agent today.

This content was developed for general informational purposes only. While we strive to keep the information relevant and up to date, we make no guarantees or warranties regarding the completeness, accuracy, or reliability of the information, products, services, or graphics contained within the blog. The blog content is not intended to serve as professional or expert advice for your insurance needs. Contact your local, independent insurance agent for coverage advice and policy services.

Artemis reported back at the end of September that Prologis, Inc. had returned for its second venture into the catastrophe bond market, looking for a renewal of its soon to mature first deal.

Artemis reported back at the end of September that Prologis, Inc. had returned for its second venture into the catastrophe bond market, looking for a renewal of its soon to mature first deal.