Your host of the QuotersCast and licensed insurance agent Renee talks to Rick Elmore who is the Founder of SimplyNoted.com.

Elmore is a former NFL football player turned medical device salesperson turned expert marketer and now industry changing tech mogul. Discover what this former linebacker is doing with his determination and grit now!

SimplyNoted writes and sends Real Handwritten Notes to your clients, customers and prospects to increase your sales and open rate exponentially. Discover what this innovative robotics technology is doing to help service based professionals increase their business today!

Check them out at: https://simplynoted.com

https://www.youtube.com/watch?v=Z-mPRNpgFPw

RENEE HOST OF QUOTERSCAST: Alright, my guest today is Rick Elmore, who is the CEO and founder of simply noted. He’s also a marketing expert, and you were a top salesperson at several medical equipment companies, and this is a big twist for a really life at 65. You spent three years in the NFL. Right, I think that’s awesome. You’re… That’s excellent, thank you. Sure. Yeah, I’m looking forward to this because this… Your technology and the company that you’ve built directly affects someone like me, and I just think you’ve got such an interesting background experience, so can you give us a little bit… I mean, you’ve only been in business since… Was it 2017? And you’re now already about 2 million annually, in revenue. That’s pretty amazing. Yeah, that’s pretty amazing. You give us a little bit of background on how you came to this. And we’ll go from there.

RICK ELMORE OF SIMPLYNOTED: Great, well, thanks for holding me, like You send my backgrounds in athletes, football, the sport that I love with the University of Arizona, played for Mike’s tops in 2006, was really lucky and had a good career, there was drafted in genitalia, you got to spend a few years there in the belly, chopped am eventually like most, or you have to hang up the shoulder pads and cleans and get into the real world, so I got into that corporate medical device sales and marketing, first years, Rocky the year, basically just take everything that was good as an athlete, Harper severance, great, get knocked down nine times, get up 10, and just applied it to my corporate career. So the first year I was Rookie, next five years, I was either a top 1% or top five sales rep in my company, and again, it was just all efforts in 2017, I just could not Scratch, so I went back and did my MBA, I just… I knew there was something else out there for me, and in 2017, I had a full-time job, I had my first child that year, I did an Ironman, but even my program launch launched my first startup.

RE of SN: So yeah, 2017 was a wild year, but I was in the Marketing class and December, but here to my program, and at a marketing professor said that handwritten notes have a 99% open rate, and I just thought that was just an amazing statistic, since we live in a very digital, digital overload world, it’s just really hard to engage people, so I thought if I can send some handers with the 99% grade, and it has to make me more successful if I can get in front of my client 99% of the time. And the classmate of on myself, I got together, I worked with some technology at a China is just a pen plotter was a very bad technology and just tested it and tested it and tested it, we just had great results and partly rose in 2018, most simply noted, fast forward five years were the largest handwriting platform in the world, were the only cup in the role that’s truly better on handwriting, robotic mean by that we leverage no op to shelf solutions, everything that we build is custom to us. I never thought I’d do this, but we’re gonna have six patents on our technology, designed through utility, we have hundreds of thousands of users on our platform every single month, it’s grown tremendously about the same as easy, but it wasn’t…

RE of SN: It’s been a lot of less winters, I’ve gone into this, but I think the solution that we provide is solving a big problem in today’s digital and AI world, and that’s just the personal tangible touch where the mailbox is empty, where nobody is competing. And that handwritten note really stands up and that mailbox…

R of QC: Yeah, I totally agree. And being in the field that I’m in, I’ve written a lot of those myself, it takes a lot of time, and so I’d like to drill down a little bit on the actual technology, ’cause I really do think this is like what you’re doing, you’re taking like you say the human touch and you’re using technology to marry it. So number one, how much of the artificial intelligence play a role in this?

RE of SN: Well, I think that’s a very buzzword now since… What was it in November 22, when Open AI released chat spent the way that we’re leveraging it right now is just helping people kind of formulate and give them ideas on what they’re gonna say, so we’re actually launching that update on our website, but it’s been a week so you’re gonna belly go and say, Hey, help you it think you know to John or help me a congratulations, or selling your house or whatever. So that’s the only way that we’re leveraging right now, what we’re trying to do is help businesses either automate it, so it becomes predictable, a part of their sales or marketing plan, or scale it, if you wanna send one or two… We can help you do that, but we actually consult and say, Hey, if you can send one or two by yourself do it yourself, but we’re trying to build a platform to help companies automated or scale it.

R of QC: Okay, so you tend to prefer to work with agencies then and larger companies.

RE of SN: So… Sure. We’re not trying to monopolize the handwritten note market by any means, we’re just… We’re trying to develop a tool that businesses can leverage within their marketing or MarTech stack where they can know at a handwritten solution, just like they have a calling solution, an email solution, a CRM, we’re trying to be the handwritten solution that they can put her to

R of QC: Outright so I know it took a lot for you to invest in this financially, so what does it look like in terms of your team and the partners that you have to get this going off the ground side, you mentioned one partner, but you have a lot of investors have you used your own money… Is that

RE of SN: Zero? We’re completely customer-funded. Not no investors. Yeah, so when I started this company, I really wanted the proof, I wanna improve myself and when I could do it, but I don’t come from a background of money, I don’t ingroup with a silver spoon or go smoother, they call it. My parents were very supportive, but we didn’t have tons of money growing up, so I really didn’t have a lot of options, so another way for me to do this was to self-funded and how we funded it was just dealing what I was good at, I would go out, identify opportunities, show the client what we can do for them, solve a problem for them, and then we close and reinvest the proceeds back in the business.

R of WC: Okay, you’re a very fascinating character to me, because from your athletic background, a, you’ll give you this it up, I’ll tell you why, because you went from football into selling medical equipment and then now you help this handwritten is… There’s nothing like this out there. And so to start this up in the way that you did, and all the effort and time that went into it, there had to have been something in your thinking process that made you decide that this thing was gonna be the thing that you were gonna spend that much time and energy on, and I would love to hear what… What was the reasoning?

RE of SN: Exactly, so I grew up in the generation without technology, I didn’t get my first cell phone until I was almost 17 years old, and it was one of those brick toivonen when I was being recruited in high school, any coach… I think it was 29 or 30 division when football offers or scholarships, but the coaches that really set out to me with the ones that sent me hand-written up that show me that they invest some time into reaching out to me, I got tons of printed letters and postcards. And that was easy to do it. So anybody who sent me a handwritten note that immediately set up when I left the 49ers in 2012, carbo set me a hand-written up and he’s a head football coach in the NFL, and now he’s back in college, but that guys a person of influence and that impacted me so much. It literally made me a… No.

<—— Tech Problems – The Zoom Froze —->

R of QC: You were in the middle of telling us about your coach would send you the hand-written note, and I just wanted to make the point that you’re a tough guy and you come across really forthright, but clearly you have a huge heart, and that’s kind of what I wanted to highlight here and you live a great story.

RE of SN: Alright, so yeah, a handwritten notes, Why did it mean so much? And why they have impacted in my life so much, so there was a good story. Back in 2012, when I was playing for the San Francisco 49ers, I left the team after that season, we went to the NSC championship game and lost write for the Super Bowl. So it was a pretty awesome year, but when I left the team, coach harbor, a very influential leader, head coach in the NFL, he’s now back in the college ranks. You sent me a handwritten note, and when I was like 23, 24 at the time, and when I got that three or four weeks later after I left, I just… It impacted my life so much. It meant so much to me that he would sit down and take the time to do it. It’s actually a keepsake, literally, I kept it, it’s in my office on my shelf and I’m gonna be able to share that with my kids some day, so that’s what we’re to do at scale for companies, I think people want to do it. And the problem that we’re solving is that they don’t have time to do it, so now we’re creating a platform that helps them to do it.

RE of SN: Again, I’m not telling anybody You should send every single handwritten, you know that you ever do through our platform, but if you’re a business, if you like systems and processes, you have a CRM, you wanna stay consistent, you wanna make sure the grammar is right, you’re not having your assistant, and you don’t have to worry about the misspelling something or the grammar is not right, we’ve built the platform that helps you automated or scale it, so you… An automated birthday card, an anniversary card, is not a holiday cards, or just send out a thank you card, which is a big part of our business is the law of reciprocity is just building those relationships. And we all know how important relationships are in business, I can develop this business if it wasn’t for my relationships, I know almost every business out there wouldn’t have their business if they didn’t have loyal relationships, so it’s all about the relationship and a good… Simple Banking Up is a way to solidify a strong relationship with our clients…

R of QC: That’s great, and I know you have… You’re big on follow-up, so I’m assuming you might have a whole system and philosophy, that’s what I’m guessing. Do you

RE of SN: Mean for follow-up, it’s just based off of triggers, so say that you had somebody come and book a meeting with you, we can automate handwritten note to be sent out after that meeting is completed, or if somebody signed up for a quote, we can automate Hey, thank you for reaching out for a quote, we’re excited to work with you, we can automate sending that follow-up part, it’s really just based off of triggers that are happening within your company CRM or software, whatever you use, any time someone pays a bill, we can automate sending your card. Hey, thanks for paying your bill, so I really set up systems that help you automate your personal touch, but it really… It’s just as easy as sending an email, if you have a spreadsheet in Excel sheet by send it to us, it’s just like Nalanda were pugin a variables high first name, every car is completely custom to that individual, so it could be as easy as you want or as complicated as you want, we just have the software, the technology, the platform, the robots, all the milling equipment in-house, all the printers in-house, we’re a one-stop solution to make sending and scaling handwrite notes as easy as possible.

W of QC: Wow, that’s amazing. So do you, as a great sales person that you are… I’m thinking about some of the big old insurance companies with thousands of agents and a lot of the independent agencies, it just sounds like this is perfect because they have Salesforce and Zapier and all that kind of stuff, this sounds like the perfect service to sort of integrate with that, have you approached them, and if so, how did that get…

RE of SN: You tried so many times. Oh really? We have… I think we saw Farmers, I’m not sure, I don’t know who our insurances or maybe they do one of our things that we have, but I get a really crappy 5 cent post card for my birthday every year from them, and I’m like literally like, Why are you sending me this, why… This literally shows me that you put zero time and effort into this, and it’s just like, This is not gonna do anything from my relationship with your company, and I’ve tried… Literally, it’s all about dollars and cents. It doesn’t matter about relationships, brand recognition, loyalty, referrals, reviews, I’m just like… I literally don’t even look at it, I get it now, I just do a straight in the trash, I says like, This is the least amount of effort your company in a possibly done we run or on printing press in our warehouse. I know how easy it is to print out these postcards, I could print 11000 of them an hour, so it’s like… Anyways, we’ve tried… And I think what happens eventually, or these companies will come around when they start seeing their competitors use it and they start seeing the success they have, but there’s usually the smaller agencies that we work with, the ones that really understand the value of a referral, the ones that really understand the value of the lifetime value of a client, or the ones that are running in anywhere from 700 to 3000 booklets a portfolio, so it’s the big mega conglomerate, they don’t even in…

RE of SN: Give you a second, I’m just like, Alright, it’s fine. I know

R of QC: You’re right, there’s second 70 sea. One thing I notice when doing research on you, you mentioned I thought this was really important that you don’t like to overlook any small opportunity because you never know where it’s going to lead, and so that kind of every… So can you give us an example of a small… Look like a small opportunity on the surface that turned out to be something big.

RE of SN: So when I first started, I did every business networking event possible, I did the BIs, the Chamber of Commerce, the vestiges, the small, private… I did the, what do you call the speaking one, hematoma, Ter Toastmasters or… I’ve done them all, and none of them are really a good fit, but I was a young entrepreneur, just trying to get out there, meet people, be around people that are doing something similar to me, and I remember I did Van in my first year and my largest I got a referral from someone at B and I to somebody two years after I left, like, Hey, you should talk to this guy. And I spent year in the program and I really did nothing for my business, but I built relationships with in band I, and they connected me to somebody that ended up being a massive six-figure client for us, so you can’t discredit any effort whatsoever. You can’t leave any stone unturned, you can’t overlook any bad experience, you have to fix every experience, you can’t say though that guy is a bad customer, he’s not a good person, you have to obsess about that stuff, and that’s what I’ve done really well.

RE of SN: That’s simply not it. It’s like I just, I will go above and beyond, go a lot further than any of our… Now, that’s why I make Gonsalves incorporate in the corporate was willing to do a lot more than my competitors or the people that I worked with, and that’s what helped me set myself amongst the crowd, so we would do the same thing here. It’s more tremendously well. It’s very exhausting that I don’t know if I can do it, and I started when I was 29. So we booked a… I don’t know if I would start it the same way, I’m a lot smarter than I was when I was 20 years old. Well, yeah, absolutely. At that 100 client, it can be just as valuable. Is that 5000 client is just… You can’t overlook anybody.

R of QC: Wow, that’s a great attitude. So what is that? When you say you go above and beyond, can you give us examples of what it was

RE of SN: That… I think it’s pride. I think a lot of people get stuck and trying to make sure that they’re right or I’m right, versus the customer, I don’t care, I’ll step down my pride in it, even if they’re way wrong, I’m like, You know what, I totally understand. We’re so sorry and just move on because it’s not worth the drag dragged out an email battle, they go on and get their friends to write bad reviews, they write the bad reviews, it’s just people have to let go of their pride, they have to look other ego, a lot of people getting a running their own business because they wanna be their own boss, but even though my own boss, I’m still more in sales, and I would say at the beckoning call more people now, I used to just be having to service my clients. Now I have to service my vendors, my employees, or clients, or engineers or developers. So I think if there’s a lot of independent insurance or business owners out there, just get with making sure that your clients are happy, even if you have to swallow your pride a little bit, believe me, it’s gonna pay off.

RE of SN: A year from now, two years from now, because they know they’re wrong and you tell them that they’re right, they’ll come back, I will refer somebody because they know you’re somebody that’s willing to be flexible and work with them. That’s great. Yeah, excellent.

R of QC: So you are able to sell these notes and letters with him without envelopes, they’re very affordably, and after talking to you now for a few minutes, I’m assuming it’s gonna be on great paper and have a quality and blood stuff with the manufacturing and all equipment that you have… And the materials you need. How is that possible? Really to be that competitive.

RE of SN: So I mean, the first four years, it was really hard, it was really hard to not get too low on price because we needed the money that we got from selling… To reinvest back in the business, we’ve invested almost a million dollars now adjust into the development of our handwriting robots, and that’s all customer bondage, so that comes from sales, that’s not to account for a run or a fourth version of our website, probably spent near another million dollars just in software development, not including capital equipment, all the mailing equipment, the printers, which is another probably 60 or 70000, so at this point now where we’re at, now that we have all this stuff in-house and we can control our costs a lot better, we’re able to get a much better price on our service, so we’re still well below, it’s gonna cost for you to go to a store and buy a car and do it yourself, you go to the store and buying greeting cards to be four or five bucks, just the car plus postage, and a lot of our businesses that the volumes they’re doing it, they’re doing it for around a dollar a cart, plus post it or selling at…

RE of SN: Again, it’s real handwritten umbrella Rank card on a 120-pound car stock, which is thicker than a whole Mark card, and it’s automated at scale, you’re not gonna have Carpathians and you worries about an injury being delayed or stuff like that, and it really is a remarkable technology and that’s what we’re trying to do is get the word out there. There’s nothing else like it. Only came in the world that’s truly built in on handwriting robot, we built her handwriting engine, we can literally take your handwriting style, all the characteristics out of it, and truly is your hand writing to put words on paper to send to your clients. And that’s like when people grasp that and they’re like, Holy crap, it’s as easy as sending an email and I can use my hand writing with my customization Ary, and it’s automated, that’s when a light bulb started exploding and they get excited and then we can’t… They get in contact with us and we help them get going.

R of QC: Yeah. Wow, that is really remarkable. ’cause from watching the robot do its thing, I wouldn’t… It looks so real, but I had no idea that you… Nickerson is handwriting, so… Yeah, go ahead, please.

RE of SN: Yeah, when we mimic a person’s handwriting is not a simple hand write or a fun conversion, so I find when you’re creating a font online, so onshore created in the 90s for the internet, so they’re tiles or of files, truetype or open type on… We actually create something that’s completely different. It’s a handwriting style, so we will pull out all the unique characteristics within your handwriting, the spacing, which is called carinthia URS, which is how your letters naturally connect to each other, so some people will connect their toes or connect or end to them together, or to age or what do to ease look like next to each other. We program, I’ll pull out all that out, program in your handwriting style, and then we actually have an algorithm that takes your handwriting style and manipulate it as it writes it, so it doesn’t matter if you wrote a 1000 as right next to each other on our robot, not one single, Hey, we’ll let the same… It rotates it, that stretches it, it makes a bigger, smaller… There’s way too much stock put into this week freer on pens, we literally… Our pen run out so much, we had to create our own pens, the type of an duties in a pen.

RE of SN: The Weta ability of the ink was thought about, it’s called viscosity, so it actually smear is really good when you like You dumb and try to smear it, so this way too much thought that goes into a simple one, two… Or the hand-written note. But were… We believe so much in it, the problem that we’re solving, we believe that handwritten notes or handwrite Mall is gonna come back with mentioned, especially being in the digital world for the last 23 years, and now we’re going to the AI world, and we’re just a platform that’s ready to help people do it. Yeah, definitely. That’s what it sounds like.

R of QC: So you’re not worried about China copying you are you…

RE of SN: I don’t care, there’s… I think in the post office, there’s like 74 billion pieces of First Class Mail alone sent every year. I don’t even want 5% of that, but it would be a nightmare to manage. So we wanna work with clients that are good people that understand the value of the service, we’re not trying to monopolize anything, I’m happy just to get out there and work with great people and provide a great service.

R of QC: Okay, so you haven’t really thought of other applications for this then, in what ways… Well, I don’t know. Just listening to it. It’s so complex. I don’t know, I haven’t…

RE of SN: Well, there’s definitely another application for individuals with writing disabilities, we’ve talked to non-profits to help them use our systems to write. But that’s just a completely different conversation.

R of QC: I was just thinking even a book or a textbook to make it look like somebody had actually physically written it, and that might be something to get rid of e-books and maybe having an alternative, would that be cheaper than regular printing.

RE of SN: Alright, not it takes what are robot… About five minutes to write one hand-written note, and that’s about 100 words, so it writes as fast as a person… We can speak it up and they write it as fast as we want, since these are machines, but the faster you go, you suffer writing quality, so we wanna make sure it looks great, so the role just scale, we just have more Robots to the production line to help us turn orders faster versus turn the machines up in speed. Okay, alright.

R of QC: And maybe lastly, I’m just curious, have you tried to infiltrate for the football organizations and with this technology and…

RE of SN: We worked with the NCAA a little bit in the early days. It’s not really our niche, we wanna work with the service-based industries, real estate, mortgage insurance, non-profit where relationships matter, where the value of saying thank you is gonna impact their business for years to come, ’cause we all bring a business… I’m trying to shut down my turn rate ’cause we all know it cost more to your client then keep your clients happy and get referrals, so we’d like to focus on those industries that value relationships. Alright.

R of QC: Well, that’s great, I wish you much. Continued success. This has been an awesome interview. And you’re super impressive. Rick, thank you very much for being here.

RE of SN: Thanks for having me. Have a great day, see you.

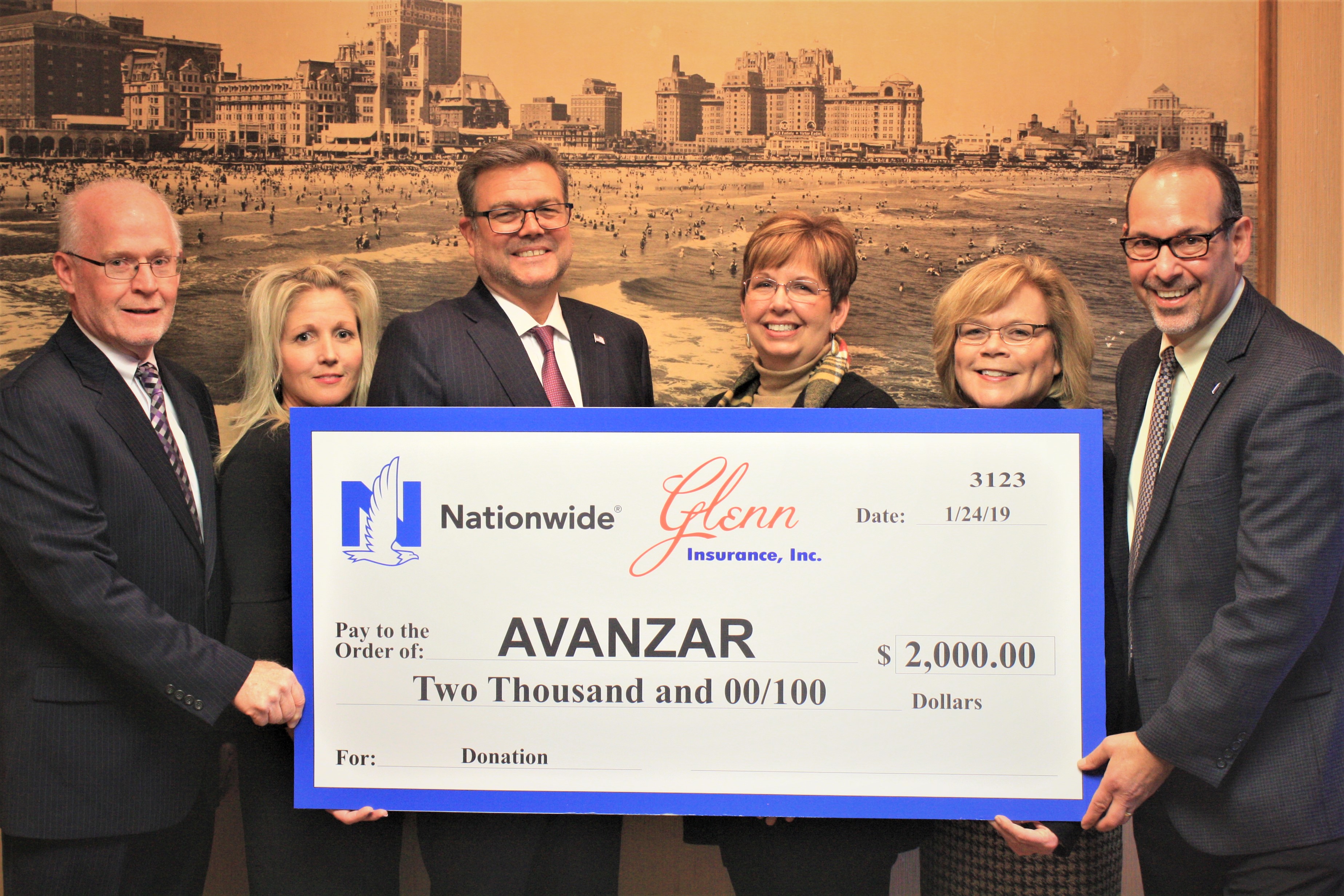

(From left to right: Michael F. Thomas, Executive Vice President, Glenn Insurance; Susan Sykes, Senior Commercial Lines Underwriter, Glenn Insurance; Tim Glenn, President, Glenn Insurance; Claudia Ratzlaff, CEO, Avanzar; Cheryl Tamasitis, Associate Vice President, Nationwide; and Ross Setlow, Territory Manager, Nationwide.)

(From left to right: Michael F. Thomas, Executive Vice President, Glenn Insurance; Susan Sykes, Senior Commercial Lines Underwriter, Glenn Insurance; Tim Glenn, President, Glenn Insurance; Claudia Ratzlaff, CEO, Avanzar; Cheryl Tamasitis, Associate Vice President, Nationwide; and Ross Setlow, Territory Manager, Nationwide.)![Medical Mortgage Loan Programs [MD–PharmD +] Medical Mortgage Loan Programs [MD–PharmD +]](https://i2.wp.com/www.leveragerx.com/wp-content/uploads/2023/04/unnamed-5-300x200.jpg?w=696&resize=696,0&ssl=1)