All businesses rely on their employees to work together and succeed when it comes to achieving shared goals. In order for your staff to feel secure in their position, creating access to health benefits can be a supportive move.

There are many reasons why you should invest in small business group health insurance. A key factor is that employee access to healthcare actually increases productivity and engagement. Studies show that adding in health benefits for employees helps increase productivity by 5%.

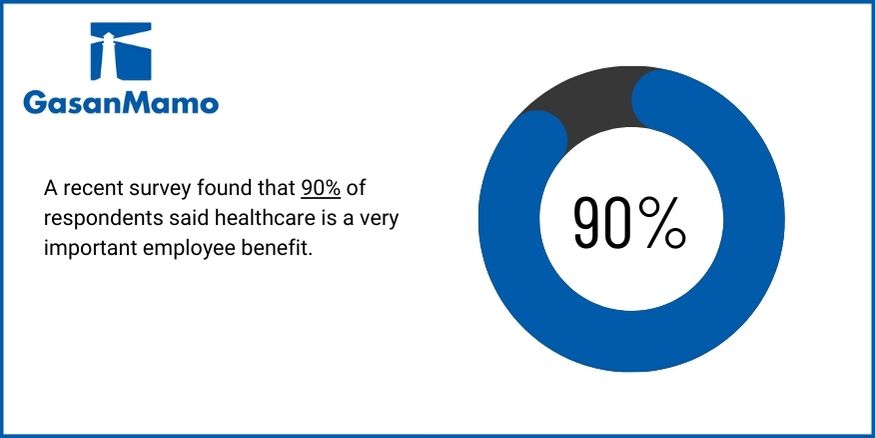

A recent survey found that 90% of respondents said healthcare is a very important employee benefit. As this can be provided through group health insurance, it’s a helpful asset that employees can use to access medical appointments as required.

Contents

- What is small business group health insurance?

- How does small business group health insurance work?

- 5 major benefits of small business group health insurance.

- Support employees with GasanMamo’s small business group health insurance.

What is small business group health insurance?

Small business group health insurance does not differ to a significant extent to large business group health insurance. However, partnering with an experienced business insurance provider ensures that the package you provide suits your individual business needs and the health concerns of your employees.

Group health insurance requirements cover the cost of medical expenses for medical investigations or treatment of an acute medical condition. This means your employees would be covered if they have a disease, illness or injury that is likely to quickly respond to treatment.

How does small business group health insurance work?

A group health insurance policy provides employees with access to healthcare on a risk pooling basis. This type of employee health insurance can be offered at a lower premium rate as the risk levels of employees are spread across all members.

Risk pooling generally lowers policy costing as group members carry the level of risk equally between them, compared to individual policies for employees and their families. This would increase costs as each policy would have to be created, assessed and managed on a case-by-case basis.

5 major benefits of small business group health insurance

Whether you want to keep valued employees within your business or simply care for your staff and their families, there are lots of advantages to small business group health insurance.

- Employee loyalty

When you offer your employees the ability to access private medical and healthcare appointments, this naturally creates a sense of loyalty and belonging. New research suggests that companies with highly engaged employees are 21% more profitable and small business group health insurance can support this.

- Talent retention

Attracting and retaining the right talent for your business can be a challenge in today’s fluctuating employment market. However, offering group health insurance benefits encourages your new hire to commit for longer. In fact, employees are 26% more likely than before 2020 to accept a new role because of a health benefit offering.

- Absence reduction

If your employees gain access to timely medical appointments, appropriate mental health support and effective treatment plans, there is evidence that shows this reduces the amount of sick days employees take. This is because prevention is the key, meaning that employees can resolve any issues before they become more serious and impact their time at work.

- Mental health support

The ability to check in with mental health support services for employees helps to boost levels of work satisfaction. Your staff can talk through any stresses that may affect their concentration and productivity at work, so they feel more equipped to achieve goals.

- Enhanced productivity

Employee motivation can be a complex area to navigate for businesses. There is a combination of factors at play, such as goal orientation and workplace engagement. However, one aspect that many business leaders are clear about is that offering employees benefits they can’t find outside of work supports increased motivation levels.

If employees are able to focus and are committed to achieving targets at work, then this helps to increase productivity and creates efficiencies across the organisation.

Support employees with GasanMamo’s small business group health insurance

We underwrite and manage the following group health insurance plans:

Vital Plan

This offers limited insurance cover for in-patient and day-patient medical treatment in hospitals/clinics worldwide, excluding the USA and Canada. Available with additional benefits for outpatients, such as GP charge cover or diagnostic tests and medical procedures.

Key Plan

A more comprehensive plan which offers a full refund of fair and reasonable fees for in-patient and day-patient treatment in participating hospitals and clinics in Malta.

Limited cover is available up to the limits of the Vital Plan for treatment received worldwide, excluding the USA and Canada. The Key Plan also comes with out-patient benefits similar to the Vital Plan and International Plan.

International Plan

Our most comprehensive plan offers full refund of fair and reasonable fees for in-patient and day-patient treatment in Malta and anywhere in the world except the USA and Canada. Direct settlement of your in-patient and day-patient bills is possible with participating hospitals and clinics.

The plan covers outpatient benefits which include cover for GP charges, prescribed drugs, specialist consultation fees, alternative therapy, diagnostic procedures, and medical emergency dental care.

At GasanMamo, we like to help you prioritise your staff. Our health insurance policies are truly adaptable and deliver exclusive medical and health benefits. We support you with everything from policy initiation all the way to claims processing.

Interested in learning more or receiving a quote?

Visit our Group Health Insurance page or reach out to us by clicking Quote.

Artemis reported back at the end of September that Prologis, Inc. had returned for its second venture into the catastrophe bond market, looking for a renewal of its soon to mature first deal.

Artemis reported back at the end of September that Prologis, Inc. had returned for its second venture into the catastrophe bond market, looking for a renewal of its soon to mature first deal.