Save as PDF

Employers have a vested interest in the overall well-being of their employees. A happy and healthy workforce increases productivity, reduces absenteeism, improves retention and lowers total benefit costs. There are several ways employers can invest in employee well-being. Employers can focus on one or more of the four pillars of well-being: physical, mental, financial and social, or they can take a more comprehensive approach.

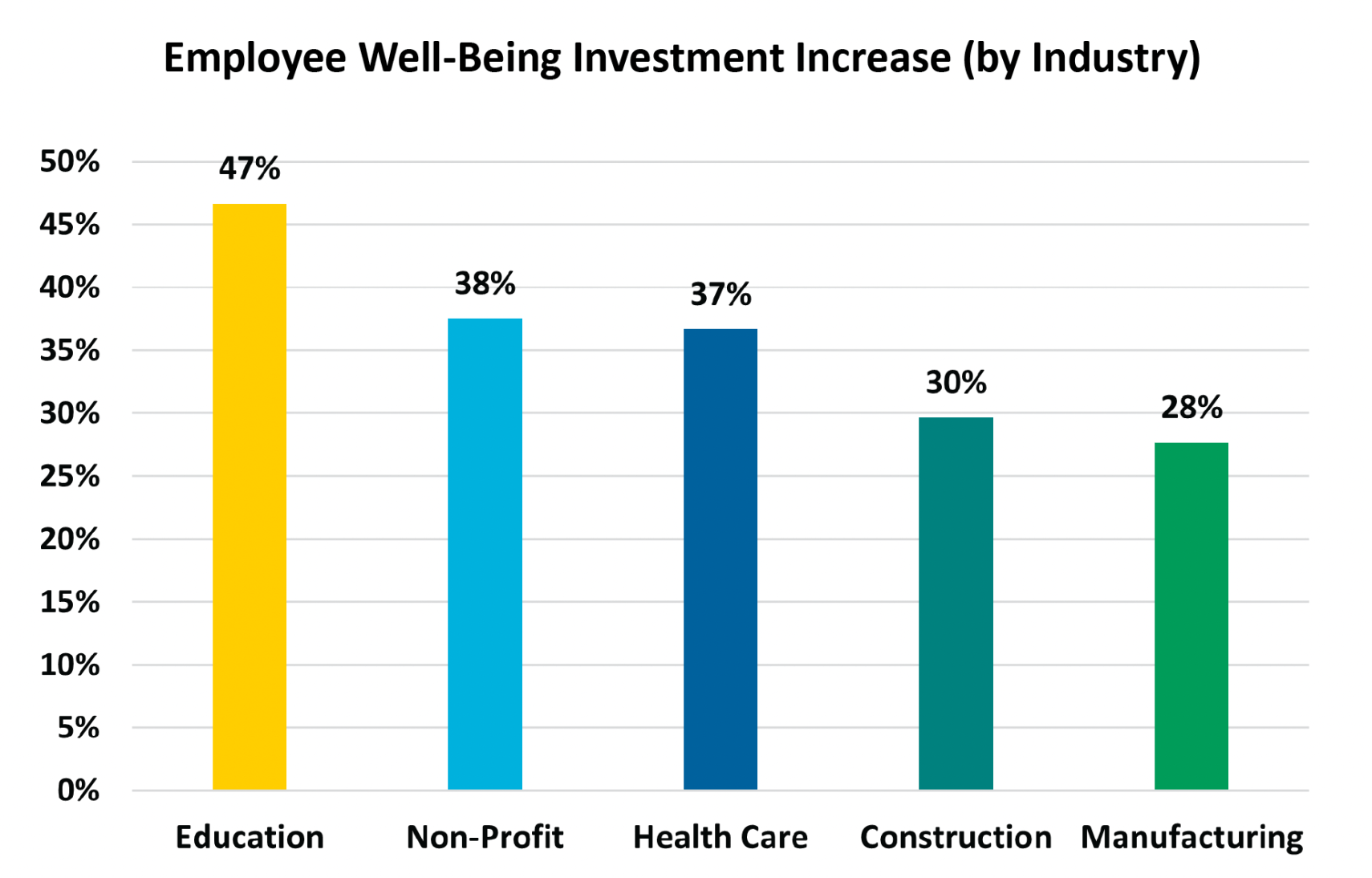

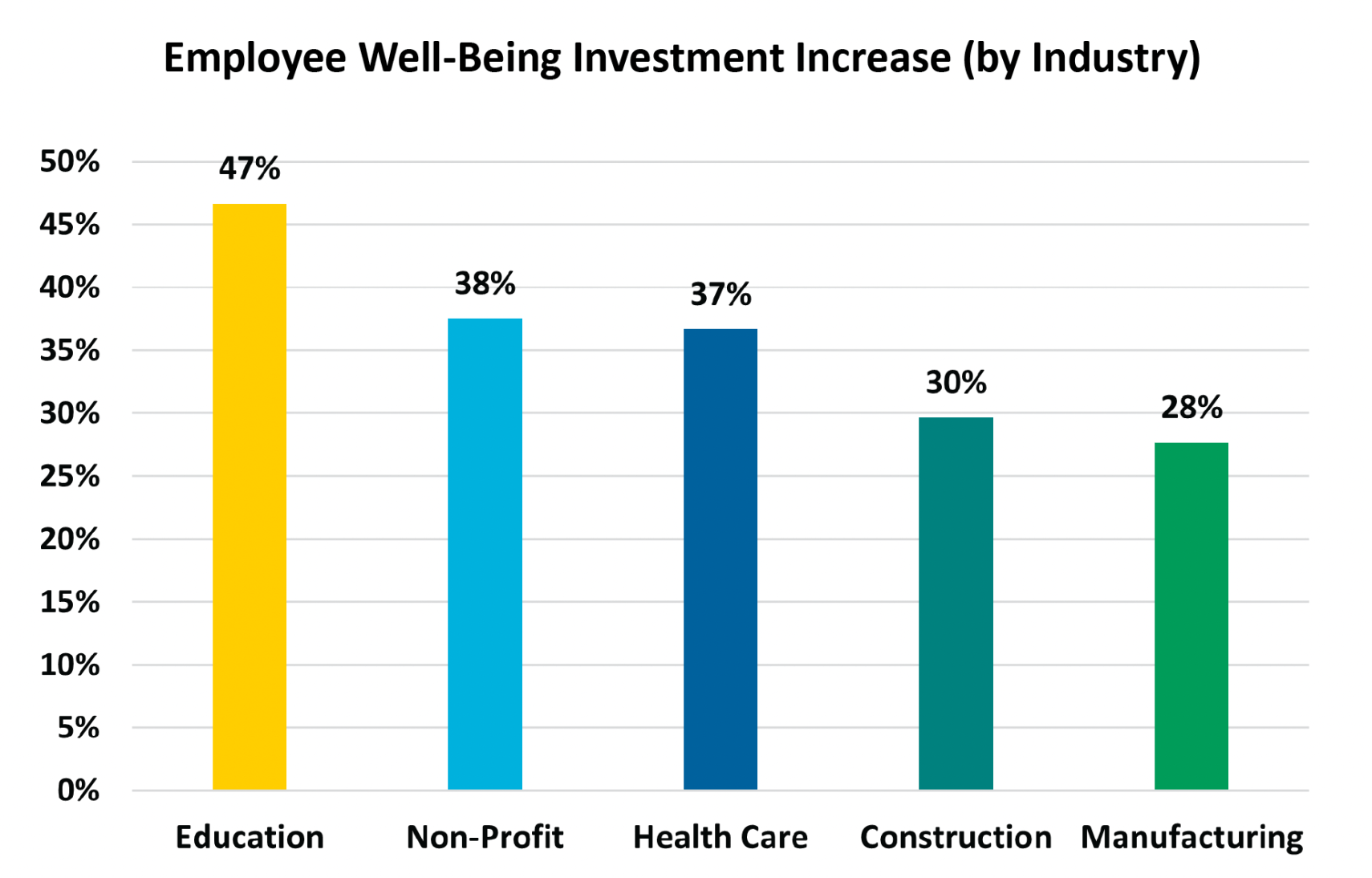

Our partners with Assurex Global conducted a poll during a webcast on March 23 to gain insight into employers’ focus on employee well-being in 2023. The survey results are displayed in the charts below and are based on 288 employer responses.

Are you planning to increase your investment in employee well-being?

Which pillar of well-being will you invest the most in 2023?

Industry Snapshot

When asked whether they planned to increase investment in employee well-being this year, we found that employers in the education sector were most likely to respond yes. At the same time, those in manufacturing were least likely. Additional industry information is displayed in the chart below.

- As noted earlier, most respondents chose mental health as the pillar they would invest in the most. We found all industries except one also selected mental health as their primary focus. The non-profit sector selected financial well-being as its main priority.

Key Findings

While still early in the year, approximately one-third of employers are committed to increasing investment in their employees’ well-being. This trend is very similar to the prior year. As we continue through the year, we expect more employers to formally define their employee well-being goals.

We encourage employers who indicated they would not increase their spending or were unsure to view employee health as another business investment requiring consistent review. For those considering investing in financial well-being, know that emergency savings and retirement plans are being tapped into with greater frequency as employees struggle with debts. For those focusing on mental/behavioral health, know that May is Mental Health Awareness Month and presents a great opportunity to highlight resources available.

Regardless of which well-being pillar(s) a company decides to invest in, it is important to remember that each area should not be viewed or treated in isolation. Financial issues within a population almost always lead to heightened concerns about mental health. Physical issues can impact emotional and social well-being and so on. Well-being offerings and resources should be viewed holistically.

Contact a Scott Benefits Consultant to learn more about our strategic and tailored approach to employee wellness, Health Risk Performance.