A top question readers ask is, “How do I track my insurance claim with Allstate?” Easily track the progress of your Allstate auto insurance claim by going to Allstate’s website, downloading the mobile app, calling an Allstate representative, or setting up email and text alerts.

Staying up-to-date on your Allstate claims status can significantly speed up your settlement, and the company offers convenient tools to help.

Our comprehensive guide answers questions such as, “Does Allstate pay claims properly?” and explains the Allstate claims process. If your rates went up after an Allstate claim, enter your ZIP code into our free quote tool above to compare rates from the top providers in your area.

How to Track the Progress of Your Allstate Auto Insurance Claim

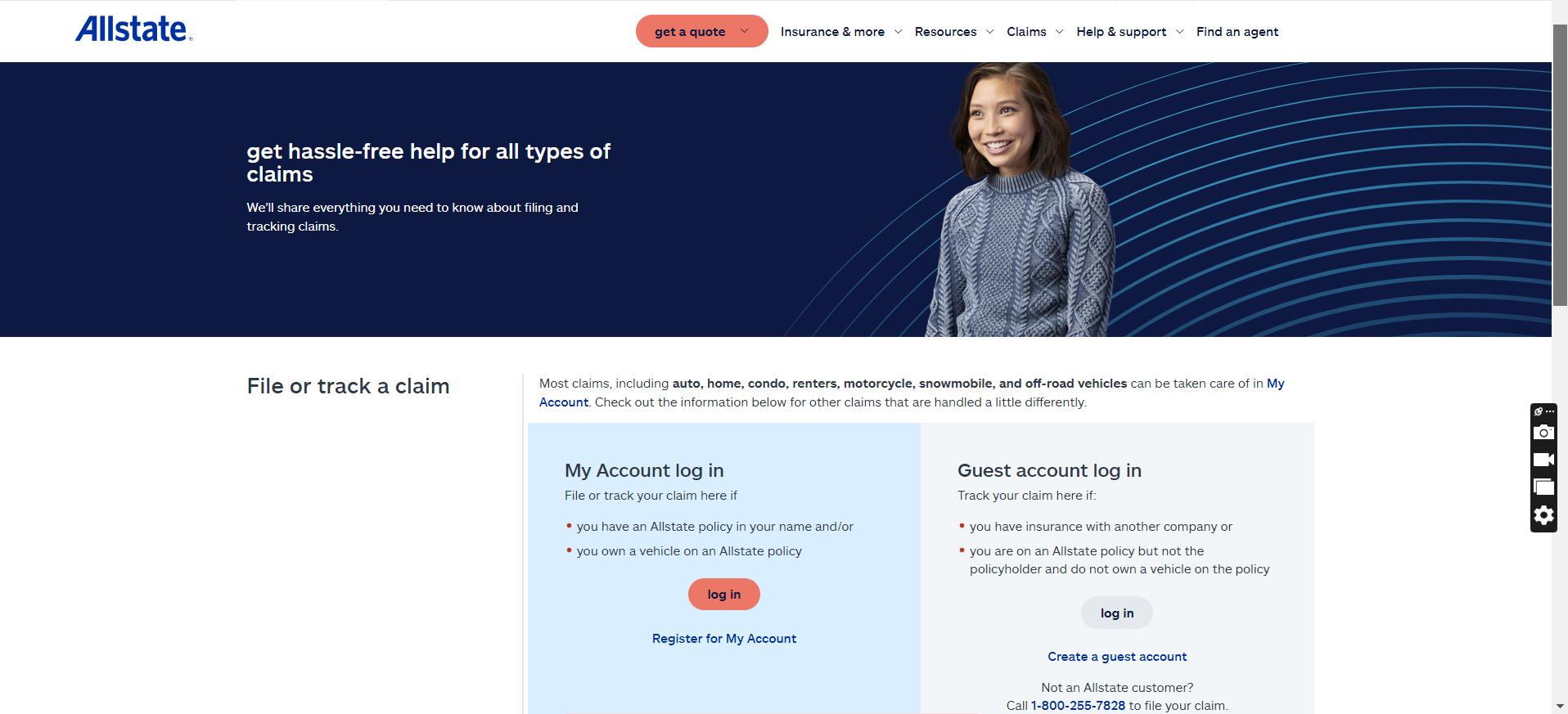

Step #1: Go to Allstate’s Website

Like many other companies, Allstate allows you to both file and track your auto insurance claim through an online portal at any time, which you’ll need an account to do. Many people choose to set up an online account when they commence their full coverage insurance or when they want to file a claim.

Once logged in, navigate to the “Claims” section to see existing claims statuses, required douments, and next steps in the process. Keep your Allstate claims login secure and accessible whenever you need to track your claim, manage your insurance policy, or get a new ID card.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

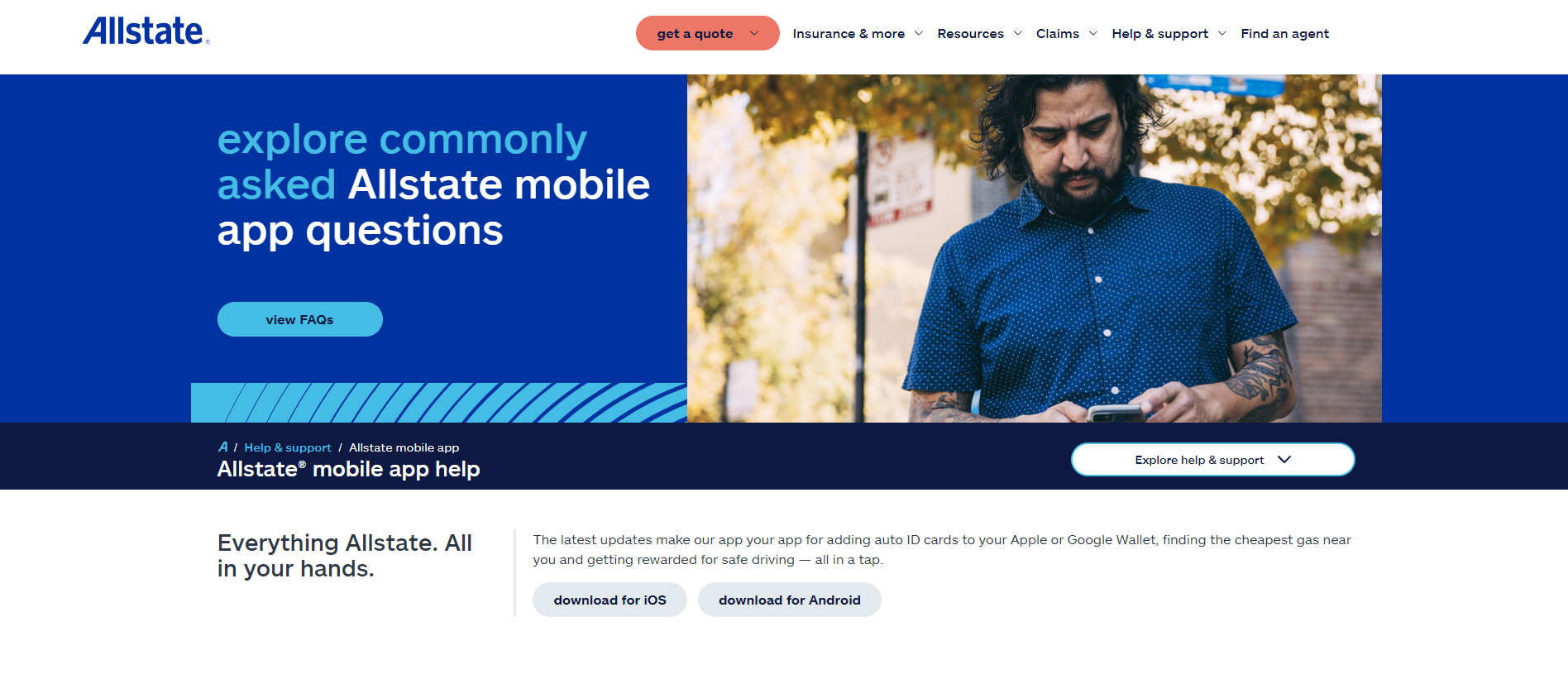

Step #2: Try the Mobile App

Another convenient resource for tracking Allstate claims is the company’s mobile app. You can also conveniently upload necessary documentation, photos, or relevant claims information from your phone.

Having real-time access to your Allstate claim with the mobile app is a great way to stay up-to-date and get a quick resolution. You can also pay your Allstate insurance premiums and access your ID card in the app.

Find out more by reading: “How do auto insurance companies pay out claims?”

The Allstate mobile app has 4.8 out of 5 stars on the Apple App Store with almost 1,000,000 reviews, while the Google Play Store gives the app a 3.9 out of 5 stars with over 100,000 reviews.

Step #3: Call Allstate

Allstate policyholders can also call the Allstate claims phone number 24 hours a day, 7 days a week, at 1-800-255-7828. Your Allstate auto insurance adjuster can give personalized updates and additional insight into how your claim is going, or even help you better understand how auto insurance works.

By communicating with Allstate constantly, you can receive updates, ask for clarification, and expedite the claims process by responding quickly to requests for documents or additional information.

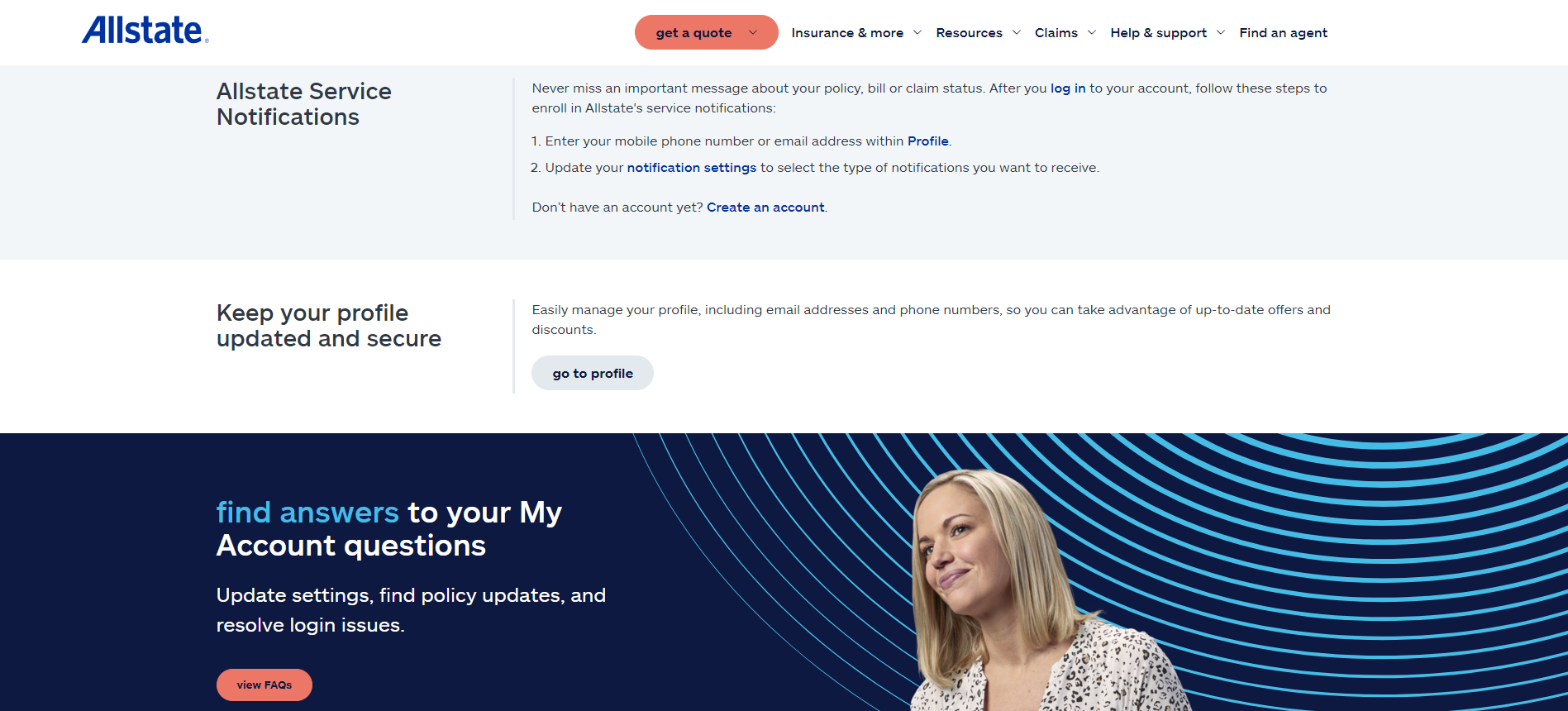

Step #4: Get Claim Alerts

Many of the best auto insurance companies, including Allstate, offer easy ways for drivers to receive real-time updates by text message or email. To set up notifications, visit your Allstate account or the mobile app.

Getting to-the-minute alerts on your claims status is essential to ensure you don’t miss important developments or requests for additional information. Keep your contact information updated constantly so you can receive convenient alerts from Allstate on your smart phone.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How Allstate Handles an Auto Insurance Claim

Once you notify the company about a claim, adjusters will gather information about the damage to your vehicle. In some cases, you may be able to submit that information digitally, as the company has a “QuickFoto” claim option. You can take photos of the vehicle damage and upload them to your online account and the company will use them to estimate repair costs.

Learn More: How to File an Auto Insurance Claim

Many readers have asked, “How long does it typically take for Allstate to process an auto insurance claim?

While you can expect Allstate to resolve your claim within 16 days in most cases, it depends on many factors, such as accident severity and claims complexity.

Tim Bain

Licensed Insurance Agent

Compare the average claims resolution time for Allstate vs. top competitors here:

Auto Insurance Average Claims Length by Provider

Should the vehicle have significant damage, Allstate may ask you to take it to a repair shop that is part of their recognized network. A technician will inspect the damage and send a report to Allstate. The company will use this information to provide you with an estimate.

You Will Need to Send Allstate Certain Information Before They Can Successfully Process Your Claim

Allstate may require contact information for anyone involved in the accident and their insurance details. In addition, you should tell them where and when the accident happened and give them the identification names or numbers of any responding officers, with a copy of the police report if they provide one. Find out more about the question: “Do you need to file a police report after an accident?”

It’s a good idea to provide any important information promptly, as this will help Allstate to process your claim as quickly as possible.

Allstate Will Notify You Once Finished Reviewing Your Claim

Allstate will contact you directly to request any more information if they need it, but otherwise, you’ll get an estimate once Allstate finishes its review. Then, you can then schedule the repair work at a shop of your choice. Usually, Allstate will pay the shop directly, or they may sometimes send you the money to cover the claim.

Remember, you’ll usually have to take your deductible into account. In addition, filing a car insurance claim with Allstate will usually result in higher rates when your policy renews.

As you can see, Allstate auto claims can cause the cost of car insurance to increase by around 41%, but the amount it goes up also depends on factors such as fault and accident severity. Learn how your driving record impacts auto insurance rates here.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

You Can Track Your Auto Insurance Claim With Allstate

You can track the progress of your auto insurance claim with Allstate by logging into your account and checking the status. You will need an online account to service your policy, file a claim, and track its progress.

7 things that may factor into a car insurance premium: https://t.co/l88FIA752R pic.twitter.com/WXaWRImq3X

— Allstate (@Allstate) July 27, 2017

Remember to send the company full details about the accident so they can handle the claim as promptly as possible. Enter your ZIP code into our free quote comparison tool below to instantly shop for prices from the most affordable auto insurance providers.

Frequently Asked Questions

How do I track the progress of my Allstate auto insurance claim?

You can track your Allstate car insurance claim by visiting the mobile app, website, calling your agent, or getting alerts. When calling your agent, the Allstate insurance phone number for auto claims is 1-800-255-7828. Discover more ways to manage your policy in our review of Allstate auto insurance.

How do I file a claim against an Allstate driver?

Allstate third-party claims are what you file if a driver with Allstate insurance causes an accident that damages your vehicle.

When does Allstate consider a car totaled?

What should I do when the other driver doesn’t have insurance?

You can file a claim with your own insurance company if you have uninsured motorist coverage on your policy. Find out more about what happens if you hit an uninsured driver.

Does Allstate pay claims properly?

You might be wondering, “Is Allstate good about paying claims?” While Allstate’s claims satisfaction has improved over the years, a 2023 J.D. Power found the company scored slightly lower than the industry average of 878 out of 1,000 points.

How long does Allstate take to respond to a claim?

After you file a car insurance claim, you can expect to get a call from Allstate within a couple days, but it can take around 16 days for the company to settle your claim.

How many claims before Allstate drops you?

While there’s no specific amount of claims that causes an insurer to drop you, Allstate can choose to drop you at any time if you file too many claims.

How long does it take to get payment from Allstate?

After your claim gets approved, you can generally expect your payout to process within a few days.

How does Allstate calculate pain and suffering?

Like many other insurers, Allstate uses the multipler method to determine how it pays out for damages after injuries. The multiplier method takes the cost of actual damages and multiplies it by a number between 1.5 and 5.

How do you negotiate a settlement with Allstate?

What is the Allstate claims phone number in California?

The CA claims phone number for Allstate is the same for all Allstate policyholders, which is 1-800-255-7828.

Does Allstate raise rates after your first accident?

Allstate, and most other companies, will raise your car insurance rates after an accident unless you have accident forgiveness. You can expect your Allstate insurance rates to increase by around 41% after an accident.

You can use our free quote tool below to instantly compare rates from the best companies near you if your Allstate rates went up after a wreck.

Do I have to pay a deductible if I was not at fault with Allstate?

While you may need to pay a deductible initially, Allstate will usually get reimbursement from the at-fault party’s insurance to help cover the costs. However, check with an Allstate agent for specifics.

Find out more details in our comprehensive guide titled, “Auto Insurance Deductible: Simply Explained.”

Why do insurance companies drag out claims?

Often, you may see insurance claims go on longer than expected so your insurer can verify information or investigate further. However, delays can also be a tactic to convince policyholders to accept lower payouts.

What is the Allstate home claims phone number?

To file a home insurance claim with Allstate, simply call 1-800-255-7828.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes.

As a parent herself, she understands the need …

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.