What You Should Know

- National General offers discounts for safe drivers of up to 23%

- Save with Nat Gen’s anti-theft, low mileage, and safe driving discounts

- Policyholders who use an app to monitor their driving behavior can save

Does National General offer safe driving discounts? Yes, you can save up to 23% for with Nat Gen safe driving discounts, such as anti-theft, defensive driving, low mileage, usage-based, and safe driver discounts.

Learn More: Low-Mileage Auto Insurance Discount

Ready to compare safe-driving options for affordable auto insurance? Simply enter your ZIP code into our free quote comparison tool above to get started.

National General Offers Discounts for Safe Driving

Like many other insurance companies, National General offers safe drivers many auto insurance discounts for affordable coverage. For instance, you can save if you have safety features in your car or haven’t had an accident in a while.

National General Auto Insurance Discounts for Safe Drivers by Savings Amount

As you can see, drivers can save up to 22% with the National General insurance safe driver discount if they go without a claim for a certain period. Also, you can save 10% for passing a Nat Gen-approved defensive driving course.

Keep reading to learn more about each safe driving discount in depth.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Safe Drivers Can Save With National General’s DynamicDrive Program

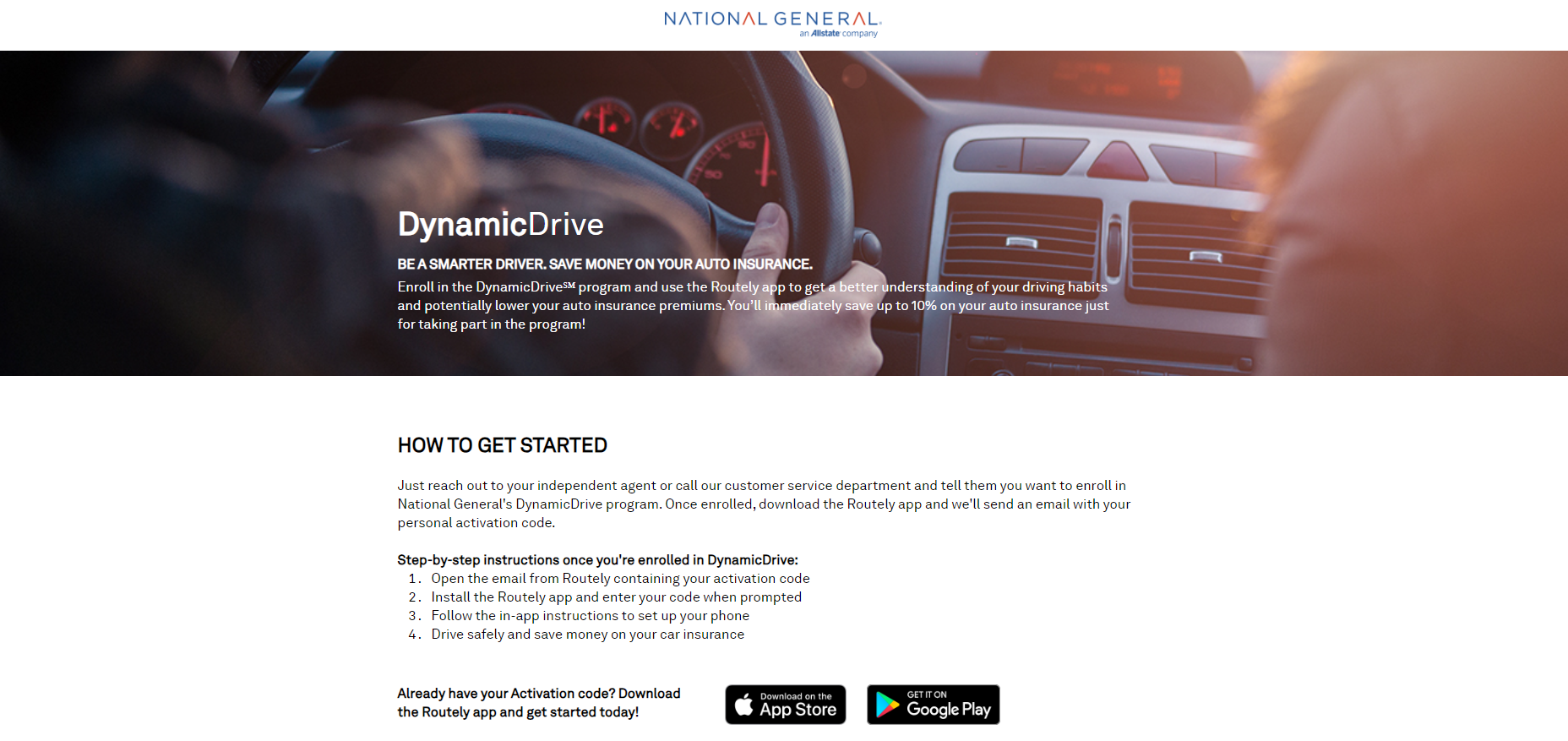

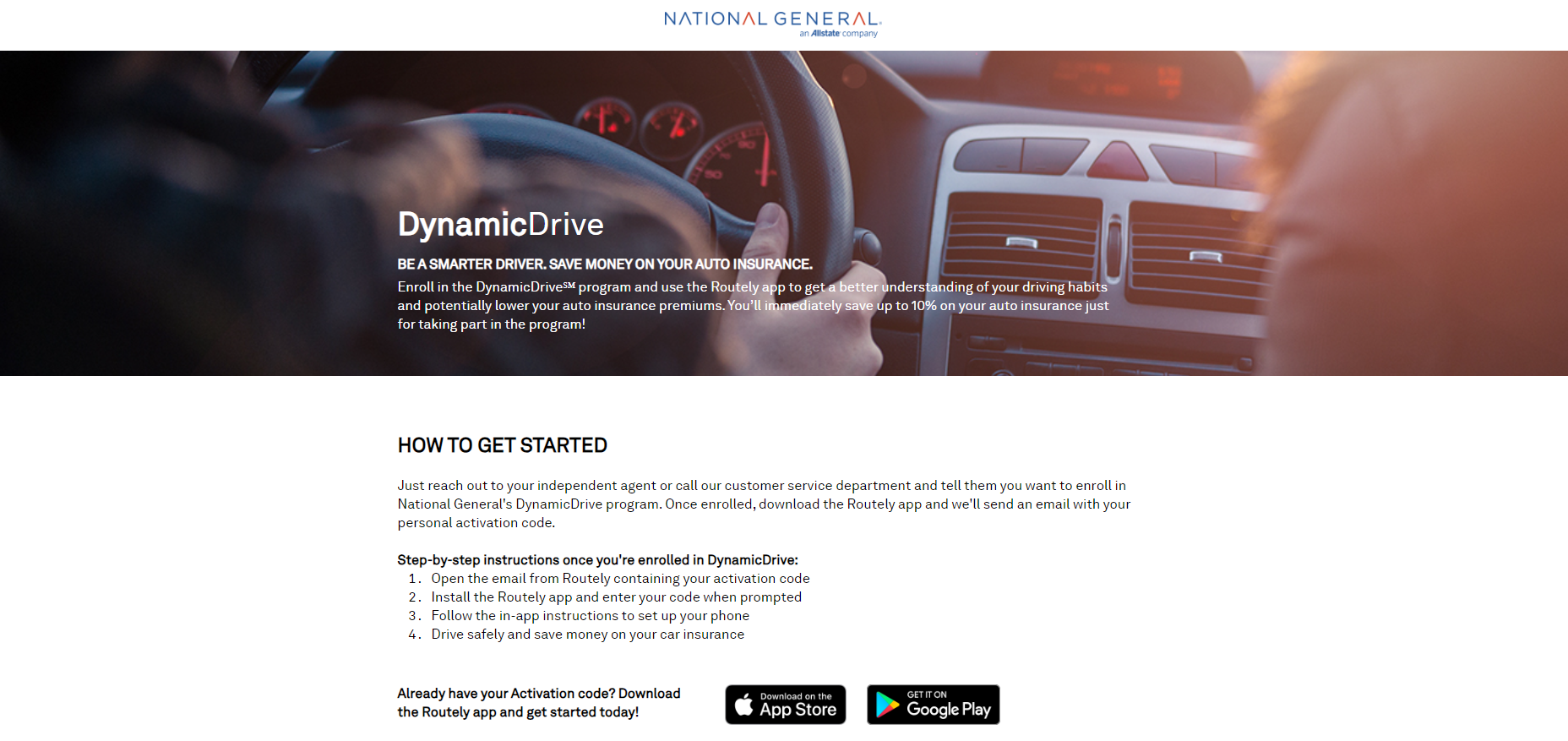

National General offers a usage-based insurance program that rewards policyholders who use a monitoring app with lower rates. The program is known as “DynamicDrive,” which could lower your car insurance rates if it finds you drive safely.

Check out the table below to see how much you could save with National General’s usage-based insurance vs. other top providers:

Usage-Based Auto Insurance Savings by Provider

To take advantage, you need to enroll in the program and will then download an app for your iPhone or Android device. The company will then email you an activation code which you enter into the National General safe driving app.

Once you have finished the setup instructions, the app will send the company data about each trip you take.

If you indicate that you’re a safer driver through your driving habits, you could lower your auto insurance premiums. However, enrolling in the National General DynamicDrive program automatically saves you up to 10%.

Brad Larson

Licensed Insurance Agent

If you don’t like the idea of devices automatically tracking your driving habits, you may want to know about affordable auto insurance companies that don’t monitor your driving.

Lower Your Nat General Rates With a Good Driving Record

In addition, drivers who have fewer traffic violations over a given period or make fewer claims may take advantage of lower rates when they renew their insurance. These rates will vary from state to state and customer to customer, so you’ll need to ask the company for specific details.

If you want to know more about violations and your driving record, learn how a DUI affects your auto insurance rates, for example.

Cars With Safety Features Qualify for National General Discounts

If eligible, you could also get lower rates when you fit safety devices to your vehicle that can reduce your risk. When your vehicle already has certain safety devices on board, you should tell National General so you may qualify for a discount.

Some of these safety features include:

- Air bags

- Anti-lock brakes

- Anti-theft devices

Wondering how much an air bag auto insurance discount will save you with National General? Call a National General representative to learn more.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Safe Drivers Get Cheap National General Car Insurance Rates

You can take advantage of several programs offering discounts through National General if you can show that you are a safe driver. For example, you can enroll and download an app to communicate your driving habits to the company.

In addition, you can save if you have fewer traffic violations or accidents or fit certain safety devices to the vehicles you insure.

Learn More: Clean Driving Record for Auto Insurance

However, the amount you can save will vary, and some discounts may not be available in all states. Enter your ZIP code into our free comparison tool below to see how much safe driving discounts could lower your National General quote.

Frequently Asked Questions

How much is the Dynamic Drive discount?

You can save up to 22% for good driving through National General’s DynamicDrive program and a 10% discount for initial enrollment. However, Dynamic Drive with National General could also raise your rates if you drive poorly.

Does National General have a student discount?

What are the National General discounts?

There are many ways to save on auto insurance with National General, by bundling auto with homeowners’ insurance, paying in full, or qualifying for a low mileage saving. You can also benefit if you have multiple vehicles on your policy or choose paperless billing.

Can you save money on your insurance with better credit?

Some states feature a confidential ranking where they calculate an insurance score based on certain factors found within a consumer credit report. These companies may use this information to determine insurance rates.

Are Safe Auto and National General the same?

Yes, in 2021, SafeAuto and National General were acquired by Allstate. Check out our review of Allstate insurance to see if the company is a right fit for you.

Why is National General insurance so cheap?

National General offers various ways for safe drivers to save on their coverage, including with auto insurance discounts such as safe driver, good student, paid-in-full, and paperless.

Enter your ZIP code into our free quote tool below to compare your National General rates against the top competitors in your area.

Can Dynamic Drive increase insurance?

Yes, while most drivers get a discount with DynamicDrive, you could see a surcharge when renewing if you exhibit poor driving behaviors through the program.

What is the discount percentage for the good driver discount with National General?

You could save up to 22% with National General’s safe driver discount if you go claims-free for a certain period.

Is NatGen Premier the same as National General?

Should I let insurance track my driving?

Allowing a car insurance company to monitor your driving behavior could lead to lower rates if you drive safely. However, you should consider your driving habits before enrolling in usage-based insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi…

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.