- Uncover Hidden Fees: Discover the top five hidden costs in employee benefits plans that are driving up healthcare expenses without employers even realizing it.

- Roundstone’s Transparency: Understand how Roundstone’s transparency can help you minimize these hidden fees and choose the most affordable options for your company’s health plan.

Why is healthcare so expensive? One factor is all the hidden costs charged by insurance brokers, network providers, Third Party Administrators (TPAs), and Pharmacy Benefits Managers (PBMs) in an employee benefits plan.

One of the nation’s largest insurance companies, UnitedHealthcare, earned about $1 billion in fees from out-of-network savings programs, according to the New York Times, citing testimony of two UnitedHealthcare executives. UnitedHealthcare charged New England Motor Freight, a New Jersey trucking company, $50,650 for processing a single hospital bill.

Sadly, the example above is only one of many. Participants in the insurance sales transaction not only collect a sometimes disclosed or visible commission but also collect what is frequently called an override or secondary commission amount, which is paid by insurance companies, according to Mike Schroeder, Founder and President of Roundstone.

Numerous hidden fees exacerbate the problem of escalating healthcare costs.

“All of these secondary fees add to the fixed cost of a health plan, which impacts the ultimate costs of the employer,” Schroeder said. “And they really provide little to no value beyond the essential services for which they have already been paid.”

Like a trick game of three-card monte, it’s easy to be taken advantage of – until you change how the game is played. Roundstone can recommend solution providers that minimize these fees. Our scorecard or rating system makes it easy to see who’s charging what upfront so you can choose the most affordable option for your company’s health plan.

Here are five hidden fees often baked into an employee benefits health plan.

1. Brokers can charge overrides or commission payments that add to the cost of an employee benefits plan.

Some brokers receive a commission or override from the PBM, the insurer, TPA, a patient advocacy tool, a concierge service to be part of a healthcare provider network, or a telehealth service. These fees are rarely disclosed and can impact the ultimate cost of the company’s health plan.

These financial incentives can also influence brokers’ recommendations, steering employers towards higher-cost options that benefit the brokers financially rather than selecting the most cost-effective or high-quality health plan solution. As a result, these hidden fees inflate the overall expenditure on the company’s health benefits, ultimately increasing costs for employers and their employees while obscuring the reasons why.

2. TPAs and network providers charge claim adjudication fees to negotiate lower costs.

Many TPAs, as well as network providers like Cigna, Aetna, and UnitedHealthcare, will charge a percentage of savings from claim adjudication or claim adjustment. Essentially, they’ll reduce the charges and then keep a percentage of those savings, which can be significant. For example, an out-of-network charge of $500,000 will be negotiated down to $300,000, and they’ll take a 40% cut of that $200,000 savings, essentially earning an $80,000 fee for a 100-employee group.

The problem’s getting worse. For one union health plan covering about 1,500 Phoenix-area electricians, these fees rose from $550,000 in 2016 to $2.6 million in 2019, the New York Times reported

“It’s very frustrating to go out and have someone pitch us that they’re going to save us money and then end up lining their pockets,” Debra Margraf, a trustee for the plan, told the New York Times.

These fees are sometimes unavoidable when working with certain network providers, but completely unnecessary when it comes to choosing the right TPA. For example, Roundstone’s in-house TPA, Bywater, does not charge these fees and yet still adjudicates each claim to its accurate cost. With Bywater, all savings are retained by the employer.

3. Provider networks charge claim editing fees to ensure vendors follow their contract.

A provider network may even charge a claim editing fee to verify that in-network providers adhere to their contracted rates. This fee is levied for auditing claims to ensure compliance with the agreed terms.

“It’s just a crazy and unjust fee because you’re essentially paying them twice,” Schroeder said. “First, you pay to access the network, and then they charge you again to confirm their providers are following the contract. It’s a form of double-dipping that’s unfair to the employers.”

4. PBMs charge spread pricing, increasing the cost of company healthcare plans.

Spread pricing is when the PBM charges the employer a higher price for a prescription ingredient than what they reimburse the manufacturer. This is typically not disclosed by the PBM and can significantly raise the cost of a company’s healthcare plan.

Spread pricing can spike the cost of prescription drugs, putting an undue burden on both the employer in the cost of their employee health benefits and the employee in higher medication costs.

Such increases in prescription drug plans are driving up the cost of healthcare and exacerbating health outcomes. More than one in four (28%) of consumers say it is either “somewhat” or “very difficult” for them to afford to pay for prescription drugs, according to KFF, a health policy researcher. And more than one in five (21%) say they have avoided filling prescriptions due to high costs. Avoiding necessary medications can significantly impact the employee’s health, resulting in greater costs for the employer’s health insurance plan as care is neglected.

A state audit of Medicaid managed care plans in Ohio revealed PBMs earned a third higher profit from spread pricing generic drugs alone.

5. PBMs can keep pharmacy rebates for their own profit.

A PBM will negotiate rebates on the price of a drug from its manufacturer. Many traditional PBMs, especially those under fully insured plans, will keep those rebates so the employer never sees a dime. Those savings become their profit, essentially a fee employers and employees pay through higher pharmacy costs and ultimately a more expensive company health plan.

But when you work with a transparent or pass-through PBM recommended by Roundstone, the rebate savings are directly returned to the employer so both the employer and employee benefit, resulting in a lower cost of employee health benefits.

How Do You Reduce the Cost of Employee Health Insurance? Roundstone’s Solution

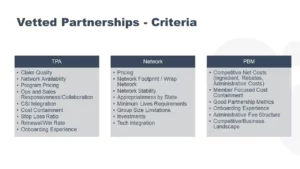

You can reduce the cost of your employee benefits by being highly selective of your healthcare partner providers.

That’s why Roundstone issues a scorecard for our vendor partners. It measures each vendor according to pricing, competitive costs, administrative fee structure, and other factors. We can recommend vendors that either don’t charge these fees or charge a minimum of fees.

Our in-house TPA, for example, Bywater, does not charge any percentage of savings. The admin fee is all it collects.

“If you use our recommended PBMs, TPAs, and other vendor partners, they’re not charging many of these hidden fees,” Schroeder said. “Many other captives will participate in these hidden fees – or they don’t pay attention to them. There’s no question that Roundstone is a leader in not accepting and avoiding hidden fees through complete transparency.”

Why self-fund? When compared to traditional insurance plans, Roundstone’s self-funded clients save an average of 20% on their employee health benefits. Our clients are guaranteed to save money over five years, a savings that has been verified by the Validation Institute.

How much can you save? Use our Cost Savings Calculator to see for yourself.